Obtain State Tax ID, Wholesale License, LLC, DBA Online.

Indiana Business License

|

|

Business License Center

|

|

Did not find your answer?

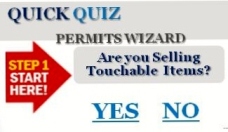

If not, you can take a 2 minute quick quiz to find out!

Did not find your answer? Just ASK ( CHAT ) WITH us!

Service Groups

Business formation occurs when you choose a business structure and file a certificate for it. For example, if you file an LLC, you structure is an LLC for tax purposes. If you file a DBA as a sole proprietor, you will be a sole owner proprietor.

After forming your business with an LLC, corporation or DBA certificate, we register your business for tax reasons such as sales tax ( seller's permit ) employment tax ( EIN, SEIN)

and business tax ( EIN, business license )

In addition, to forming your business, and registering for tax, you may need a professional license e.g., contractor's license, a health permit, tobacco or transient vendor's license.

You can select to have the filings expedited at check out or call us for same day service.

What Our Clients Say About Us

We ask some of our clients what they think about the experience working with us. Here is what they think